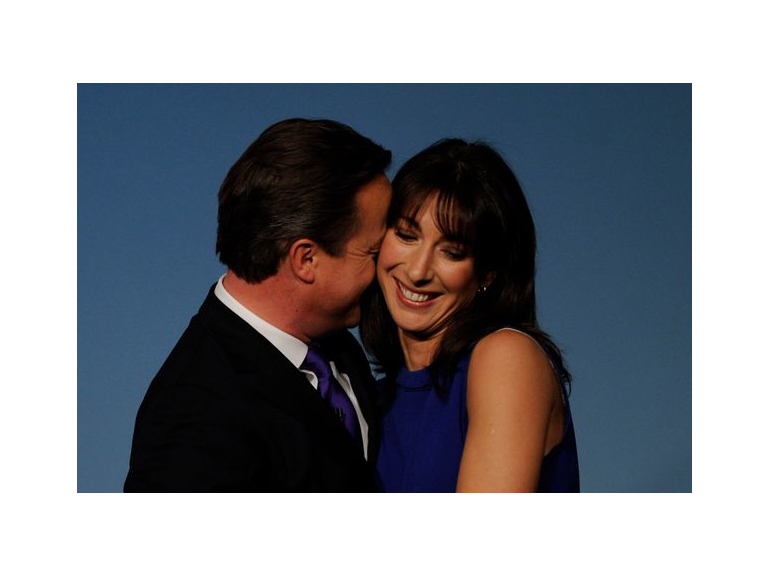

Introduced first during Thatcher’s government, the new £1000 transferable tax allowance, believed by the Prime Minister to bolster marriage is to be introduced in April 2015, at the height of the next general election campaign.

Given that the allowance will not be available to couples whom are higher rate taxpayers (in which one spouse is paid £42,285 from 2015/16) this could infuriate many families, particularly in the wake of recent child benefit cuts. The allowance will apply to both civil partners and married couples, but what of those who are separated, divorced, widowed or just plain single?

As a divorce lawyer, I am of course aware family breakdown costs the taxpayer an estimated £46 billion a year, therefore of course it’s in the interest of government to counteract this devastating trend by supporting marriage via the income tax system, but whether £3.85 a week will be enough to be meaningful is highly debatable.

Currently the government is paying families up to £7,100 to live apart, so the marriage tax break needs to compete. It needs to counter this perverse incentive by encouraging couples to formalise their relationships.

Becoming the Women’s Lawyer has been my goal for several years. With the recent changes in the legal system and to legal aid entitlement, which affect women’s issues in the main, I decided this was the...

The following Cookies are used on this site. Users who allow all the Cookies will enjoy the best experience and all functionality on the site will be available to you.

You can choose to disable any of the Cookies by un-ticking the box below but if you do so your experience with the Site is likely to be diminished.

In order to interact with this site.

To show content from Google Maps.

To show content from YouTube.

To show content from Vimeo.

To share content across multiple platforms.

To view and book events.

To show user avatars and twitter feeds.

To show content from TourMkr.

To interact with Facebook.

To show content from WalkInto.