In the last budget the Chancellor George Osborne said he will scrap the annual self-assessment tax return and replace it with a 'digital tax account' from early 2016.

While this sounds like quite a big deal at first it probably means simply that the current online tax return system will be beefed up and auto-filled with as much information as HMRC knows about you and your affairs. You will still need to check it and add in extras, and since these are likely to change regularly you will in effect still have to complete a self-assessment every year. Sorry.

Currently about 12 million people use self-assessment to declare income from self-employment, property rental, investments, part-time jobs etc., plus around 5 million small businesses use the system too. However, not everyone who is on self-assessment at the moment will go straight into the new system – around 2 million individuals will be excluded from the initial wave of participants, but everyone should be using the system by 2020.

Taxpayers using the system can choose to pay tax in instalments or as a lump sum later on.

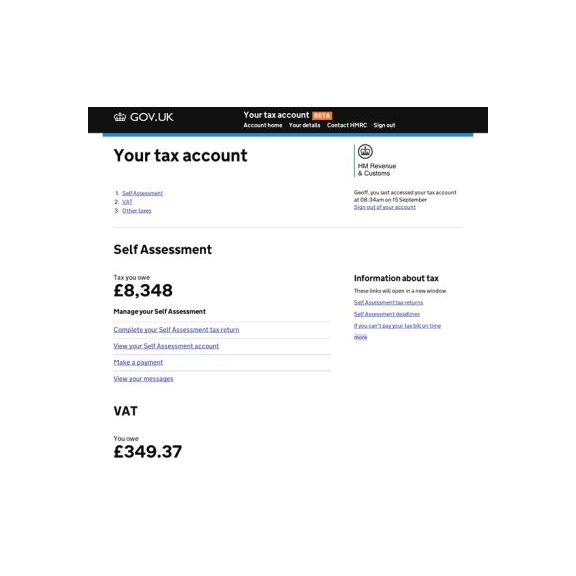

The service has been given the nice friendly name of “Your Tax Account” and HMRC state “The aim of this service is to make filing tax easier for small to medium enterprises businesses. It is estimated this can save these businesses between as much as £17 million and £25 million next year. This service will provide improved tools and a tax dashboard for small businesses”.

The service has just passed its “live Digital by Default Service Standard Assessment” which means essentially that it is well on the way to becoming a reality and isn’t just a governmental pie in the sky idea invented for the Budget!

As a business or self-employed person it makes very little difference to the work you need to do to produce your annual accounts, it might just make them slightly easier to report to HMRC.

If you are paid via the PAYE system you already pay tax as you so it will make no difference to you at all unless you have other income, for example if you’ve recently started renting a property or have sold an expensive asset and need to pay Capital Gains Tax on it.

If you’re anywhere in the Farnborough area and need help or advice on preparing for self-assessment do call Kass Verjee of The Financial Management Centre – he really is a local expert you can rely on to keep your accounts in order, whether they’re digital or otherwise.

The following Cookies are used on this Site. Users who allow all the Cookies will enjoy the best experience and all functionality on the Site will be available to you.

You can choose to disable any of the Cookies by un-ticking the box below but if you do so your experience with the Site is likely to be diminished.

In order to interact with this site.

To help us to measure how users interact with content and pages on the Site so we can make

things better.

To show content from Google Maps.

To show content from YouTube.

To show content from Vimeo.

To share content across multiple platforms.

To view and book events.

To show user avatars and twitter feeds.

To show content from TourMkr.

To interact with Facebook.

To show content from WalkInto.