Is now a good time to invest in property, or are we in a property bubble that’s ready to pop? And are there better ways to invest anyway, with fewer headaches?

We all know house prices are an obsession with us Brits, and with the media reports of house-price bubbles and buy-to-let millionaires you’d think buying houses and letting them out is a foolproof way to make money. And property investments are, well, as safe as houses, aren’t they?

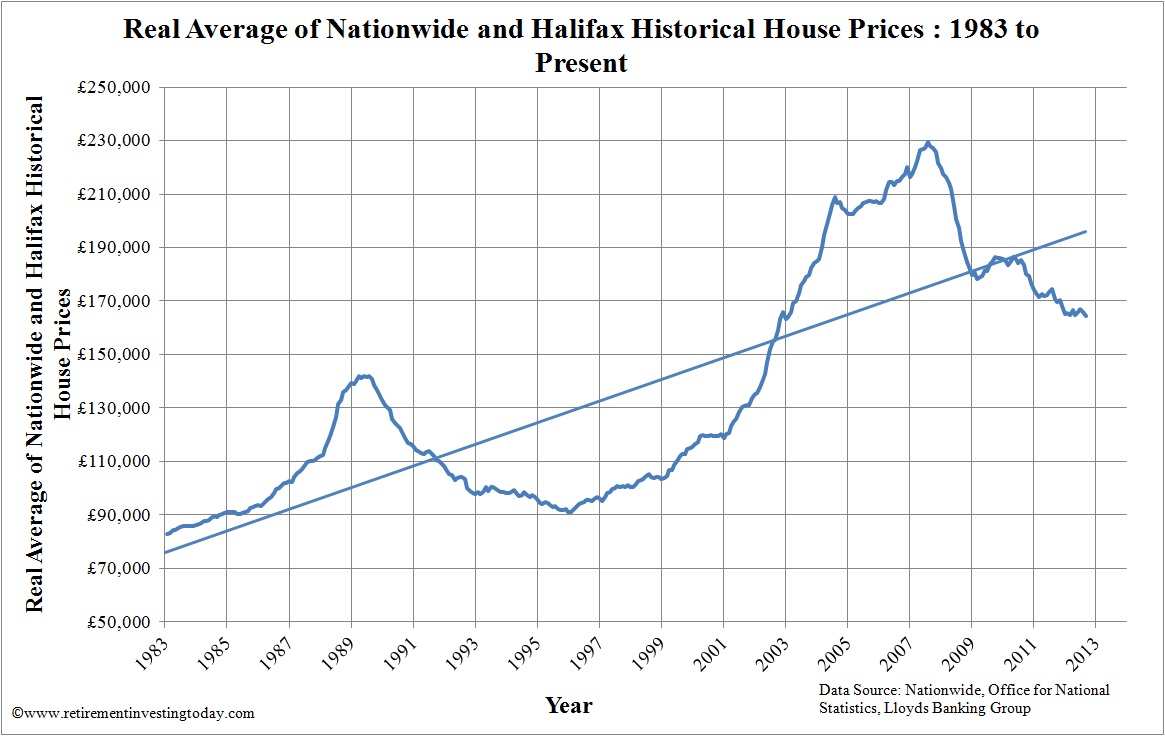

One look at the house price chart for the last 30 years shows they very much aren’t:

In fact there are a great many investments with much better-looking performance charts than that!

If you bought a house at the peak in 1989 it would be 12 years before your house was worth what you paid for it, and if you bought in late 2007 you may still be waiting for values to recover.

However of course property has a huge advantage that other forms of investment don’t: You can borrow potentially hundreds of thousands of pounds to buy a house using the property itself as security. In contrast, no bank will lend you significant sums to buy shares, gold, diamonds or fine wines, no matter what the investment performance charts say.

Also property letting produces a regular monthly income (barring void periods) regardless of the value of the property itself, so as long as this covers your outgoings (the mortgage plus costs and fees) then any increase in property value is icing on the cake. The national average rental yield is about 5%, according to the Association of Residential Letting Agents.

Realistically in the long term property should always increase in value since the UK population is growing, which means an ever-higher demand for homes.

Becoming a landlord is a daunting prospect, but once organised you should find that property management is quite straightforward. Many start whilst holding down their day jobs, with some going on to make it a full-time, and lucrative, occupation.

Alternatives To Buy-to-Let

It is possible to invest in property without actually buying a single house or having a single tenant.

In the end there’s nothing like owning your own portfolio of property which you can manage as you see fit, possibly with the help of a reputable letting agent like Newlife Lettings.

Past performance is not a guide to the future. Market and exchange rate movements may cause the capital value of investments and the income from them to go down as well as up and the investor may not get back the amount originally invested. The information contained in this website does not constitute an offer of, or an invitation to apply for securities in any jurisdiction where such an offer or invitation is unlawful, or in which the person making such an offer is not qualified to do so.

The following Cookies are used on this Site. Users who allow all the Cookies will enjoy the best experience and all functionality on the Site will be available to you.

You can choose to disable any of the Cookies by un-ticking the box below but if you do so your experience with the Site is likely to be diminished.

In order to interact with this site.

To help us to measure how users interact with content and pages on the Site so we can make

things better.

To show content from Google Maps.

To show content from YouTube.

To show content from Vimeo.

To share content across multiple platforms.

To view and book events.

To show user avatars and twitter feeds.

To show content from TourMkr.

To interact with Facebook.

To show content from WalkInto.